Take Back Financial Control

Debt Consolidation

It can be a challenge to juggle multiple different loans with different repayment schedules. A debt consolidation loan will let you bid your debt management stress farewell and streamline your financial life.

Debt consolidation describes the process of rolling multiple smaller loans, such as credit cards, personal finance or car loans, into a single, overall loan product. That means no more worrying about numerous different interest rates, saving you money and helping you pay back your loans faster.

In addition, you’ll be less likely to forget and miss repayments, reducing the amount you’ll have to pay in penalty fees.

A debt consolidation loan means keeping your credit score safe, your bank account healthy, and your mind at peace. If you would like more information on your eligibility for an EFCO debt consolidation loan, please reach out to our team at 0800 102 159.

Product Coverage

- Credit Cards

- Store Cards

- Personal Loans

Product Features

- Only one loan repayment to manage

- Choose an ethical lending partner

- Protect your credit score

Sharia Advisory Firm

We have received Sharia certification as a mark of compliance from Sharia Review Bureau (SRB), a Bahrain-based Sharia advisory firm licensed by the Central Bank of Bahrain.

SRB is the corporate world’s leading Sharia advisor, with a scholarly presence in over 21 countries across the US, Europe, Africa, GCC and Asia. They offer professional Sharia advisory and audit services to financial institutions including banks, insurance operators, asset management firms and Fintechs.

They oversee and supervise our financial products in a Sharia compliant manner. With their guidance, we have become the first enterprise in New Zealand offering diverse Sharia compliant financial products guided by ethical principles.

LEARN MORESharia Board

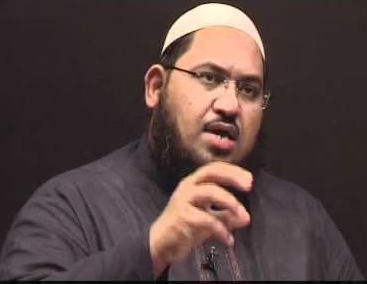

Our Sharia Board members, Mufti Muhammad and Mufti Irshad, are highly experienced representatives from the Shariyah Review Bureau in charge of ensuring the Sharia compliance of our financial products.

They work closely with us to ensure that our asset financing, personal loan and debt-based offerings follow Sharia regulations.

Mufti Muhammad Board Member

Shaikh Muhammad has over a decade of experience as a Sharia consultant and academic in international Islamic finance.

Mufti Irshad Board Member

Shaikh Irshad is a member of the Sharia Board of the Standard Chartered Bank of Pakistan and has advised banks and financial institutions worldwide.

Charities We Support

We don’t rely on penalty charges for revenue. We apply late payment charges intended as deterrents in the event that a client defaults on a payment. We do not consider these payments as company income and donate them to our chosen charities, Variety New Zealand and the Umar bin Khattab Learning Academy (UKLA).

Variety New Zealand is dedicated to supporting initiatives to eradicate poverty and transform the lives of disadvantaged Kiwi children. They provide kids access to a happier, healthier childhood and build the foundation for a better future.

The UKLA is dedicated to enabling children’s access to learning. They provide children an environment in which they can develop intellectual potential, grow, and excel.

Talk to us now

Talk to us now